Ohio Homestead Exemption 2025 Form. How do i apply for the homestead exemption. The exemption takes the form of.

If you are applying for the 2025 tax year, you must include your 2025 ohio adjusted gross income, which may not exceeded $38,600 in order to qualify. Ohio’s homestead exemption allows qualifying senior citizens, and permanently and totally disabled ohioans, to their property taxes by exempting $25,000 of the home’s market.

The homestead exemption is designed to provide tax relief to eligible homeowners by shielding some of the value of their home from taxation.

Ohio Homestead Exemption 2025 For Seniors Loren Raquela, The homestead exemption is a valuable tax reduction providing summit county homeowners an average savings of $535 per year. The exemption takes the form of.

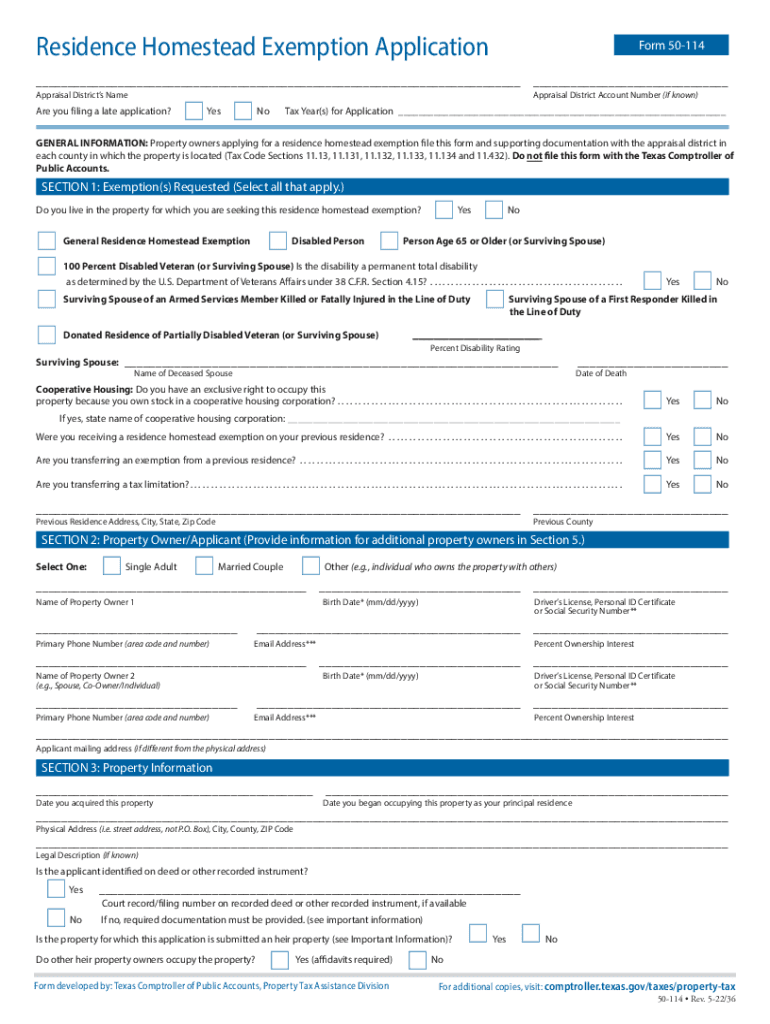

Collin County Homestead Exemption 2025 Helga Kristin, All homeowners who qualify for the homestead exemption will receive a flat $26,200 property tax exemption on the market value of their home. The homestead exemption allows senior citizens and permanently and totally disabled ohioans to reduce their property tax bills by shielding some of the market value of their.

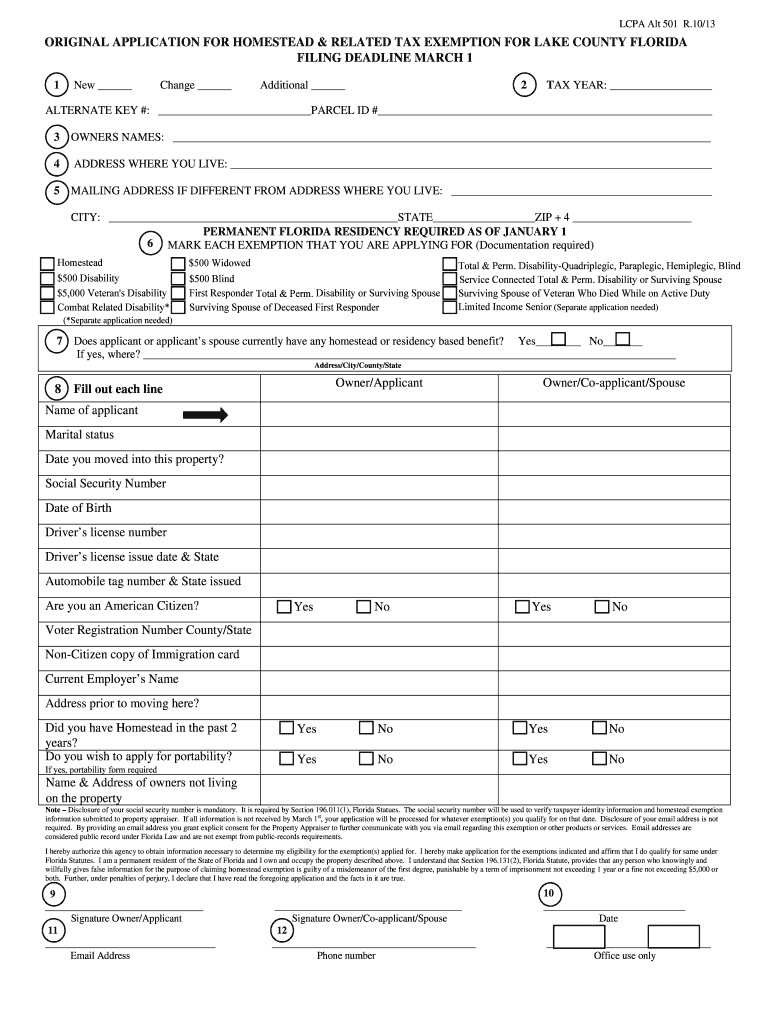

Montgomery County Texas Homestead Exemption 20192024 Form Fill Out, The homestead exemption is a valuable tax reduction providing summit county homeowners an average savings of $535 per year. All homeowners who qualify for the homestead exemption will receive a flat $26,200 property tax exemption on the market value of their home.

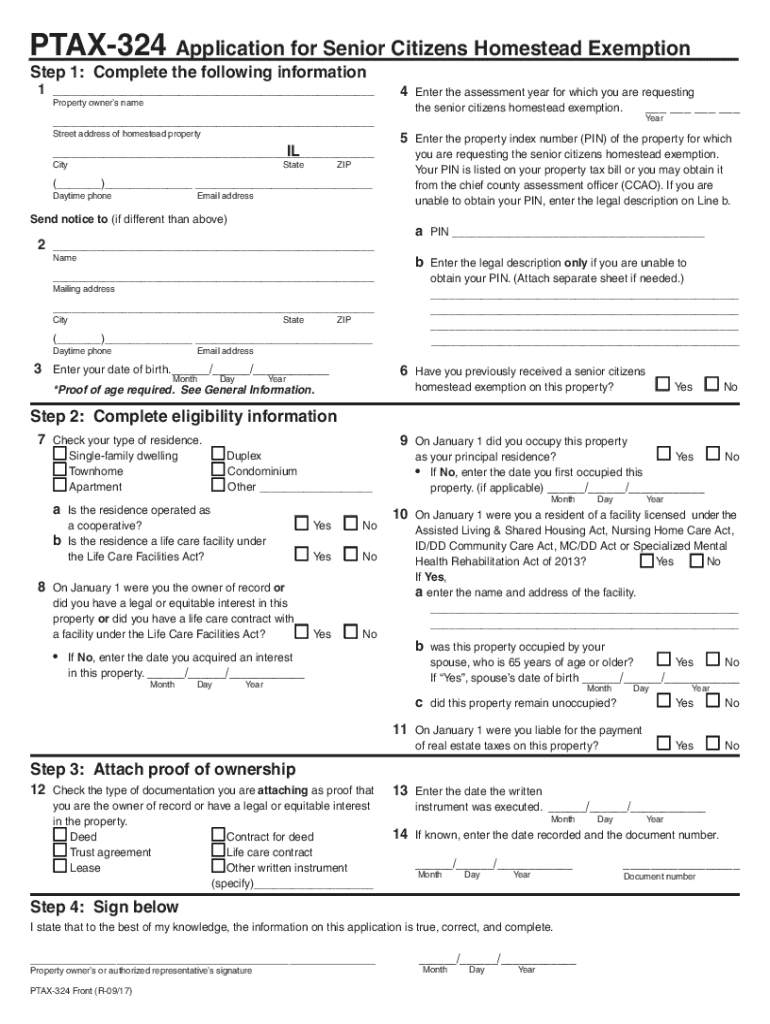

Kendall County Homestead Exemption 20222024 Form Fill Out and Sign, The application form is available from all county auditors, online on the. The homestead exemption is a valuable tax reduction providing summit county homeowners an average savings of $535 per year.

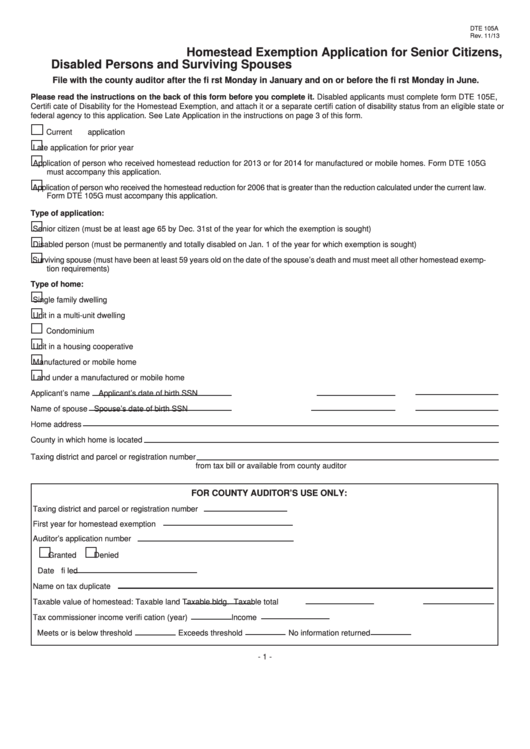

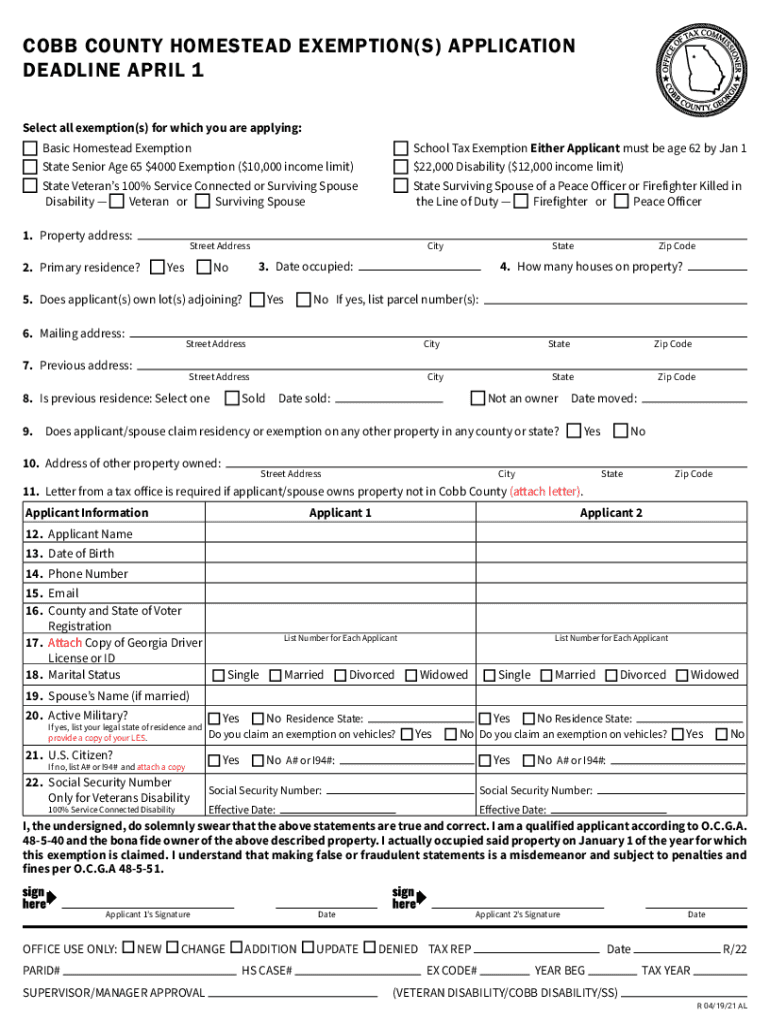

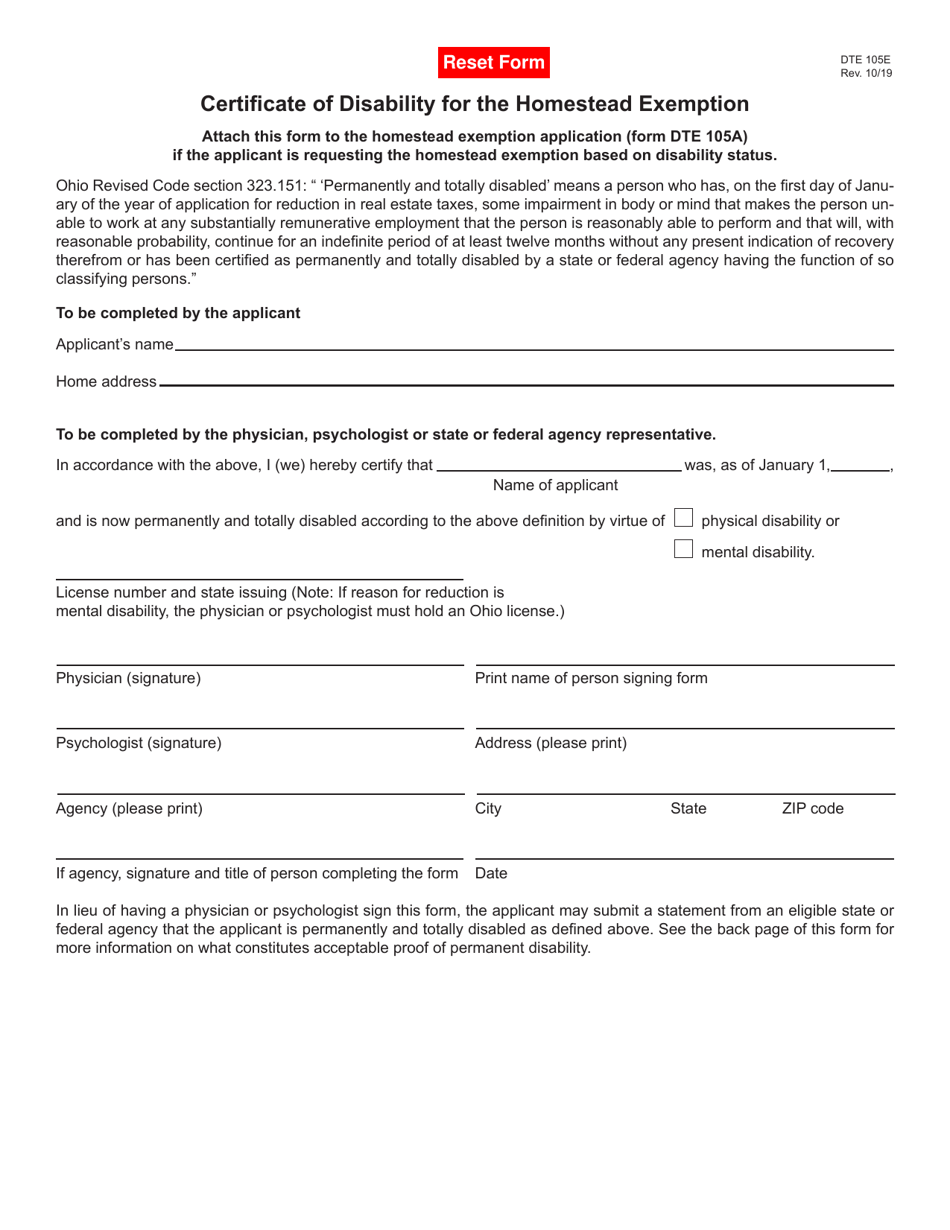

Cobb Homestead Exemptions 20212024 Form Fill Out and Sign Printable, The homestead exemption application (dte form 105a) may be completed and mailed to the erie county auditor’s office, 247 columbus ave., sandusky, oh 44870; The homestead exemption allows qualifying senior citizens, and permanently and totally disabled ohioans, to reduce their property taxes by exempting $22,000 of the home's.

Ptax 324 20172024 Form Fill Out and Sign Printable PDF Template, The homestead exemption allows senior citizens and permanently and totally disabled ohioans to reduce their property tax burden by shielding some of the market. How do i apply for the homestead exemption.

Form DTE105E Download Fillable PDF or Fill Online Certificate of, 1 for estate planning purposes, i placed the title to my property in a trust. How do i apply for the homestead exemption.

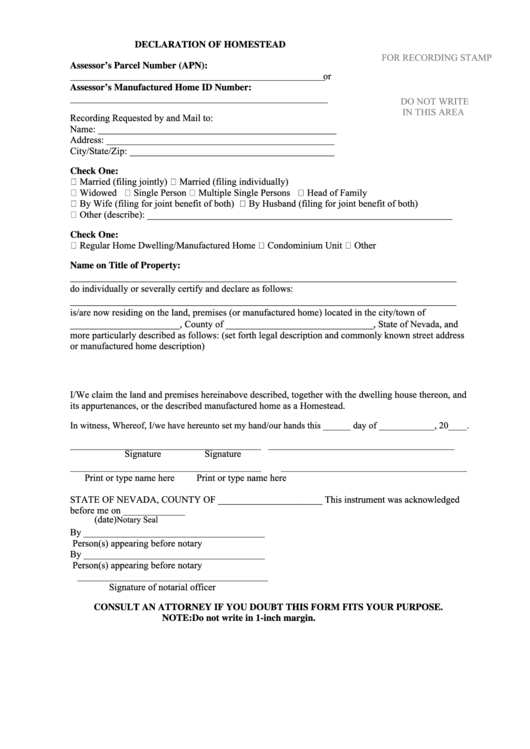

2025 Declaration Of Homestead Form Fillable Printable vrogue.co, This is a statewide program, administered by county auditors under rules established by the ohio legislature and the ohio department of. The homestead exemption application (dte form 105a) may be completed and mailed to the erie county auditor’s office, 247 columbus ave., sandusky, oh 44870;

Application For Senior Citizen S Homestead Exemption Lake County, The homestead exemption allows qualifying senior citizens, and permanently and totally disabled ohioans, to reduce their property taxes by exempting $22,000 of the home's. An official state of ohio site.

Brazos county homestead exemption Fill out & sign online DocHub, The homestead exemption is a valuable tax reduction providing summit county homeowners an average savings of $535 per year. The homestead exemption application (dte form 105a) may be completed and mailed to the erie county auditor’s office, 247 columbus ave., sandusky, oh 44870;

The homestead exemption allows senior citizens and permanently and totally disabled ohioans to reduce their property tax bills by shielding some of the market value of their.