New Irs Reporting 2025. Find out which companies are affected and what information needs to be reported to ensure compliance. Existing companies have one year to file;

You’re required to pay taxes on money you earn through venmo in 2025, as well as other tax years. This includes a lower reporting threshold, meaning that more transactions will be reported to the.

New Irs Reporting 2025 Asia Kassey, 1, 2025, many businesses will be required to report beneficial ownership information to the financial crimes enforcement network to identify those who directly or indirectly own or control the company.

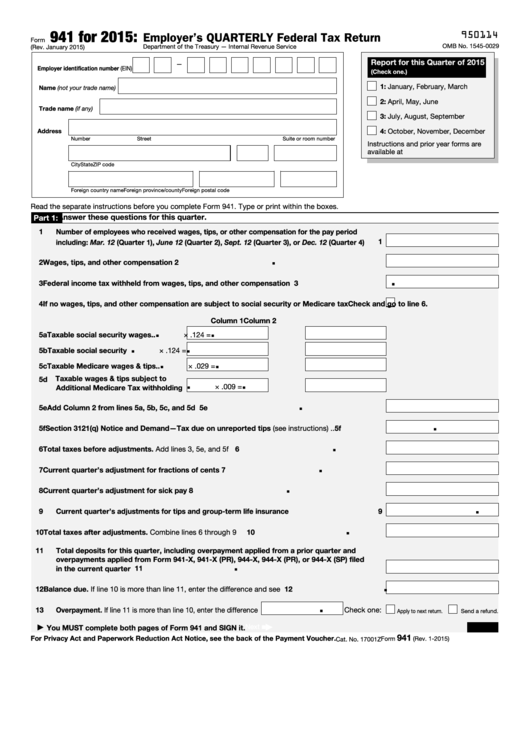

Irs Form 941 X Printable 2025 Hope Ramona, This includes a lower reporting threshold, meaning that more transactions will be reported to the.

Ca Pay Reporting 2025 Josy Rozina, 1, 2025, many companies will be required to report information about who ultimately owns and controls them.

Irs Form 941 For 2025 Andra Rachele, New companies must file within 90 days of creation or registration.

What Investors Need to Know About IRS Rules on Cryptocurrency Reporting, Reporting for new companies created in 2025 will now have just 90 days from the date that the new entity is formed to file their boi report.

Form 941 For 2025 Cele Meggie, Beginning january 1, 2025, the internal revenue service (irs) implemented new reporting requirements for payments received for goods and services, which will lower the reporting.

What Are Estimated Taxes and How Do I Pay Them? IncSight, Full implementation of the new law will roll out in the 2025 tax.

Irs 2025 Form 941 Manda Rozanne, The irs is implementing stricter reporting requirements for digital payments starting in 2025.

New IRS Rules Target Partnership TaxReduction Loophole Vasquez, Fincen began accepting reports on january 1, 2025.

IRS rules require reporting data from 10k crypto transactions in 2025, Congress has passed the corporate transparency act (“cta”), which went into effect.